Dogecoin has recently showcased impressive resilience as it hovers around the $0.34 support level, despite undergoing a notable 14% drop from its earlier price of $0.39. This shift in price dynamics has caught the attention of both traders and analysts, who are keenly observing its potential for recovery amid market volatility. The established $0.34 price […]

What is NFC? A Technical Guide to Near Field Communication Technology.

What is NFC? A Technical Guide to Near Field Communication Technology.

What is NFC? A Technical Guide to Near Field Communication Technology

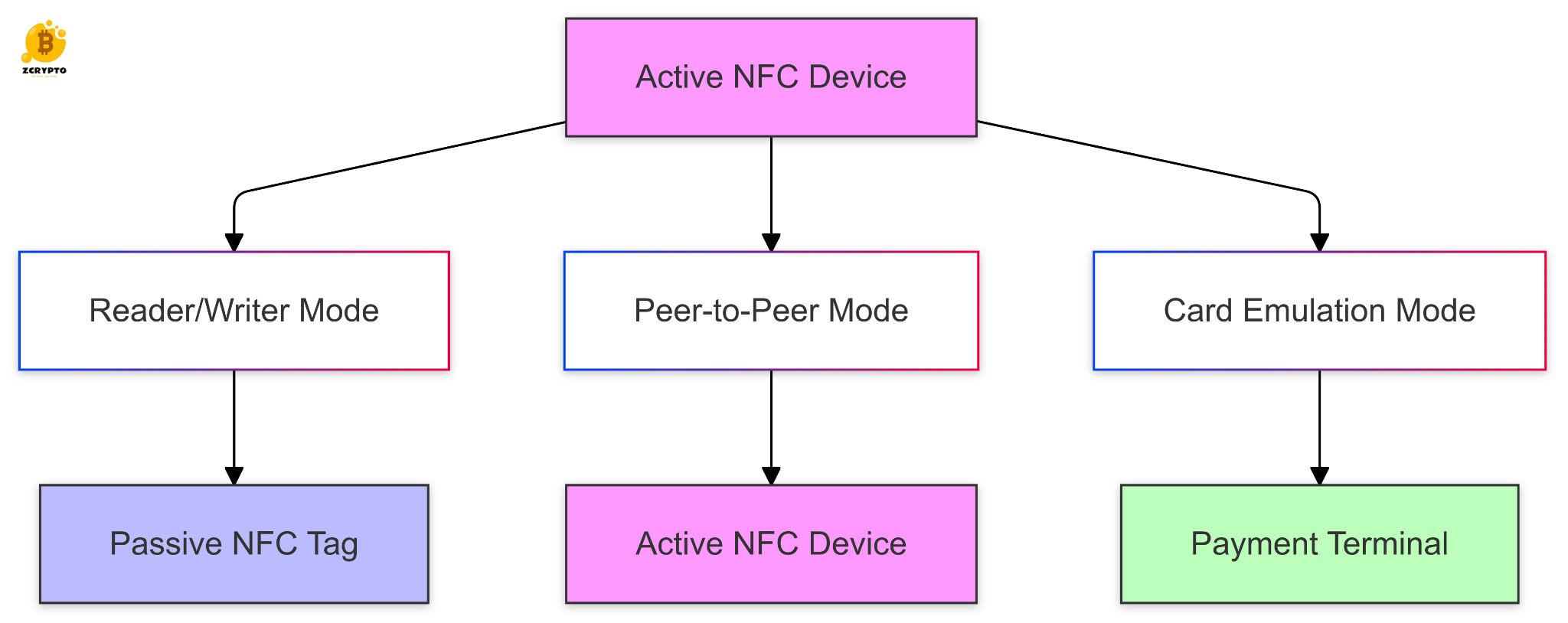

NFC transforms short-range wireless data exchange through electromagnetic field induction between compatible devices. This analysis examines NFC’s technical foundations, practical implementations, and operational characteristics. What is NFC? A Technical Guide to Near Field Communication Technology. How NFC Technology Works NFC operates through electromagnetic field induction at 13.56 MHz, enabling data transfer between devices within approximately […]

Dogecoin Faces 14% Drop: Key Levels for Future Recovery

Yesterday, Dogecoin faced significant selling pressure, plunging 14% from the $0.39 mark. This decline has raised caution among investors, but the meme coin remains resilient, currently holding firm at a crucial demand level. This area is critical for Dogecoin’s future trajectory, as sustaining this support could set the stage for a fresh rally to new […]

Top derivatives players in Brazil join rival exchange A5X | Markets

A5X, the new Brazilian derivatives and futures exchange, has announced the addition of five international partners: IMC Trading, Jump Trading Group, Optiver, XTX Markets, and ABN Amro Clearing. With the exception of ABN Amro, the other four firms are major market makers in the derivatives segment. Market estimates suggest that these companies collectively account for […]

Optiver, XTX Markets among consortium to back launch of Brazilian derivatives exchange A5X

Optiver, IMC Trading, Jump Trading Group, XTX Markets and ABN AMRO Clearing Bank have invested in A5X, a new Brazilian derivatives exchange which is set to begin operations by 2026. The Series B strategic investment follows a previous funding round and will specifically fund the investment in talent and technology necessary for A5X’s launch. The […]

Demystifying Derivatives–Clarifying Interest Rate Risk Management

Introduction to Interest Rate HedgingThe term “interest rate derivatives” often elicits uncertainty, even among seasoned corporate finance teams. Similar to other risk management instruments, many perceive these tools as complex. However, because interest rates remain volatile, impacting borrowing costs, businesses managing variable-rate loans or planning major capital expenditures must now prioritise these tools more than […]

3DBenchy Starts Enforcing Its No Derivatives License

Nobody likes reading the fine print, least of all when you’re just downloading some 3D model. While printing a copy for personal use this is rarely an issue, things can get a lot more complicated when you make and distribute a derived version of a particular model. Case in the point the ever popular 3DBenchy […]

As Domestic Investment Stalls... Korean Investors Flock to U.S. Bitcoin Themed Stocks and Derivatives

As Domestic Investment Stalls... Korean Investors Flock to U.S. Bitcoin Themed Stocks and Derivatives

As Domestic Investment Stalls… Korean Investors Flock to U.S. Bitcoin Themed Stocks and Derivatives

20% of Futures ETFs Held by Koreans Large Sums in ‘Ethereum Leverage’ as Well While investment in Bitcoin spot ETFs is blocked domestically, Korean investors have turned to U.S. Bitcoin themed stocks that they can trade. Large sums of domestic investors’ money have flowed into Bitcoin futures ETFs and leverage products that are available for […]

China NFRA Issues Margin Rules for OTC Derivatives Transactions

VM requirements will commence on 1 September 2026. IM requirements will be implemented in three phases, starting with the largest institutions. Subscribe Subscribe to Regulation Asia to gain access to APAC’s leading platform for news, analysis, research and verified data on financial regulation. Select More Information below to view our subscription packages or you can […]

derivatives giant faces growth challenges, new opportunities By Investing.com

CME Group Inc. (NASDAQ:), the world’s largest financial derivatives exchange with a market capitalization of $82.6 billion, finds itself at a crossroads as it navigates a complex landscape of market volatility, regulatory changes, and emerging competition. According to InvestingPro analysis, the company maintains a “GOOD” overall financial health score, positioning it well as it approaches […]